Should I Pass Money Down To My Kids Now?

I often get the question, “is it better for me to give money now, while I’m alive?”. A very understandable query particularly from our clients.

I often get the question, “is it better for me to give money now, while I’m alive?”. A very understandable query particularly from our clients.

The FHSA is one of the most generous tax incentive programs I have seen in my whole career as a Financial Advisor. If you have

Does it sometimes seem that your phone, tablet, laptop etc. knows what you are thinking? You poke around for something on the web, whether it

Investment firms have started to publish their investment forecasts. These mostly state where they think the S&P 500 index will end up. So far, it

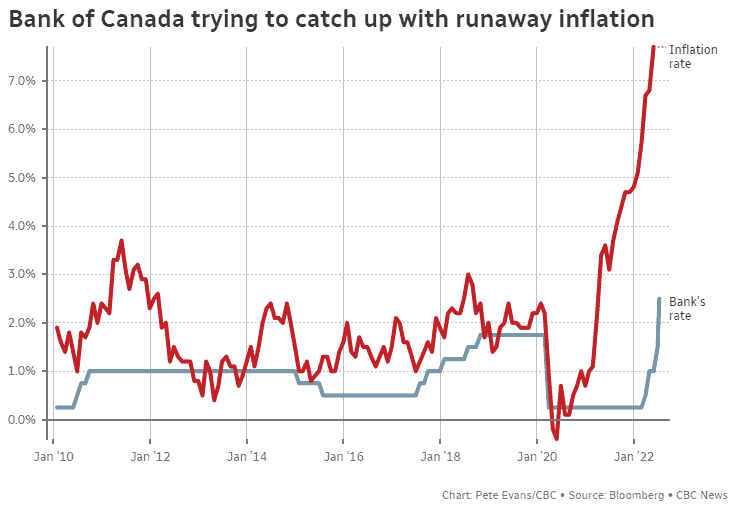

For the past few years we have been stuck getting 1% (and most often Less) on any cash we had sitting around in our chequing

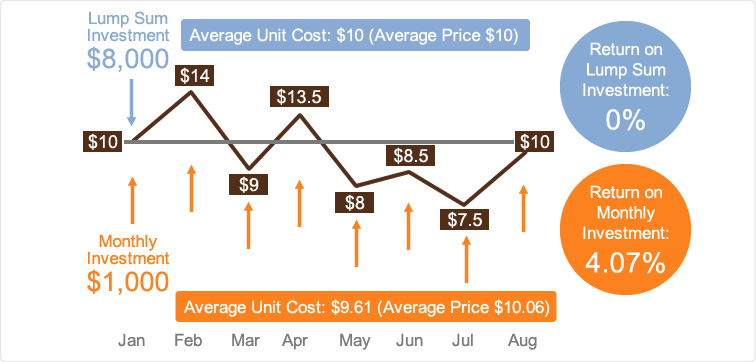

Investment prices have come down over the past few months. It might seem ironic for an advisor to write something after investment markets have come

2 years ago I read of an elderly Alberta woman who was defrauded of over $240,000 through 26 scams over 10 months. These included her

Within a few weeks, the world as we know it has change immensely. Germany has been been upping their military might by supplying thousands of

In talking with clients and friends over the past few months, it seems many have already booked (or at least are in the planning stages

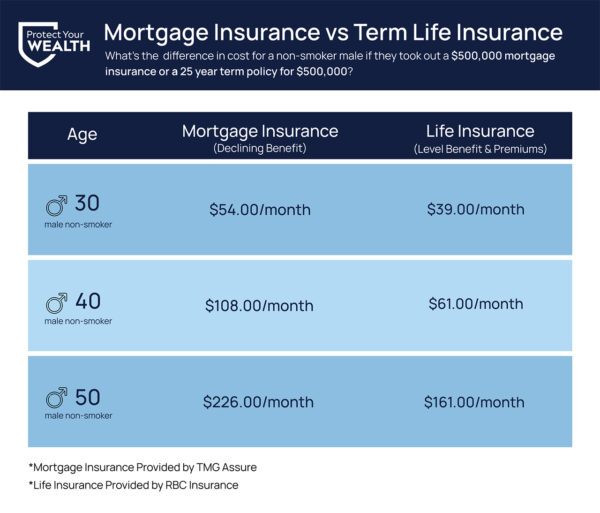

Yes, you read that right. If you tick the “YES” box, to have life insurance on your mortgage, you may not actually collect the life

The Liberals are set to release a much overdue Federal Budget on April 19th 2021. You are probably well aware that the Covid money being

Cheryl and I moved away from a quiet corner of South Surrey called Ocean Park to our current neighbourhood, in 2016. We had lived in

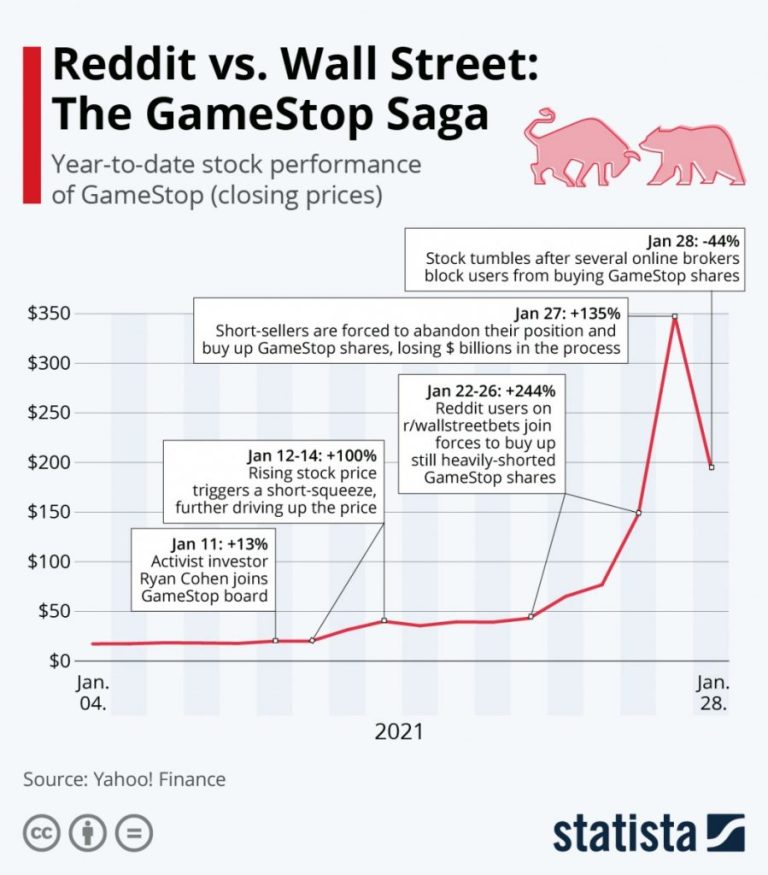

Although I believe most people are investing based on a long term view, there are many people who are not. The latter group see the

Reading this, you probably fit into 1 or more of these 3 categories. 1) You are looking to invest money, 2) you have money sitting

I’ve seen it over and over, my entire Financial Advising career; there are always people trying to guess when the best time to invest is

Is “the market” getting ahead of itself? Sure, things are looking better than they did a couple of months ago but, there still is a

OFFICE TOLL FREE

1 (866) 274-1222

SOUTH SURREY / WHITE ROCK OFFICE

3388, Rosemary Heights Crescent, Suite 217, Surrey, BC V3Z 0K7

VANCOUVER OFFICE

2050 – 1050, West Pender Street, Vancouver, BC V6E 3S7

SOUTH SURREY / WHITE ROCK OFFICE

3388, Rosemary Heights Crescent, Suite 217, Surrey, BC V3Z 0K7

VANCOUVER OFFICE

3388, Rosemary Heights Crescent, Suite 217, Surrey, BC V3Z 0K7

LEGAL

SOCIAL NETWORKS