Although I believe most people are investing based on a long term view, there are many people who are not. The latter group see the “stock market” as simply a place to speculate, day trade, gamble, in. We saw some fairly big examples of this last week. This was (and is) being done through the use of social media and what I’ll call a gang of people, trying to stick it to the big money (in this case hedge funds). Before I get into that a bit more however, let me first lay out what the equity market does at its core and in the end, does this market tussle really mean anything to you and me.

I use the term “equity” market rather than its synonym “stock” market because equity is a much clearer definition of what it actually is. Equity means “ownership” and in this case, ownership in businesses. Through the equity markets, that ownership can be transferred from one owner to another through the “trading” of the stock or shares in any business. The stock is in essence the piece of paper. The equity is what it actually is.

A basics of buying and selling in the equity market is much like the buying and selling of potatoes in the grocery store. When you buy a potato, you are getting something you need. The store is getting paid to sell you the potatoes and the grower is getting paid for producing the potatoes. With all the transactions around potatoes, the price of potatoes goes up or down based on the demand for potatoes in relation to their supply. If people rush out and starting buying up potatoes heavily, the price will eventually go up. As that happens or continues, potato farmers and investors will recognise that there is money to be made producing potatoes and will do so. “Hey, you used to be able to sell potatoes for only $1, but now you can sell them for $2. Let’s get in this business!” Eventually, more potatoes are grown which in turn eventually levels or brings down the price. This is a regular market driven (Economics 101) balancing of supply and demand through a reallocation of resources and eventually the re-normalising of the price of potatoes.

For anyone who lives in a free market society, this mechanism takes place in every part of our daily lives and it is very good. Without it, you would either have low supply or none at all. We would not get what we need (or want) and / or the price would be so high that people couldn’t afford to buy or would find an alternative that is cheaper.

The equity markets does exactly the same thing. It creates a market, where people can buy and sell pieces of businesses that are in existence. At the starting of a business, money has to be invested. This provides the money for companies to innovate and create products and services, through people’s invested capital. The inevitable creation of products and services, gives us variety and choice. In the case of potatoes and food production, along with increasing the supply of a product, it also allows technology and efficiencies to be implemented which in turn, keeps prices down.

Business ventures bring innovation to market. These businesses often offer to us things we don’t realise we need until they are made available to us. People (or companies) see this new thing that is available and think, “WOW this is SO cool. I need this!”, or “Why didn’t I think of this?”.

You can go through thousands of years of history and more so, the past 100 years of history and create an endless list of innovations that we enjoy: things which now seem very basic like centrally heated homes, light, cars, adhesive bandages, refrigerators, microwaves, vaccines, TV’s, cars, computers, internet, smartphones etc. The list is endless. Which brings me back to how the equity market is like buying potatoes…

The equity market provides a platform for you and me to buy into various businesses. As I said, at a company’s inception or at any other time while it is growing dramatically, it needs money and attracts that money by attracting investors by offering an ownership stake in the business. The business in turn can use the money to invest in their business to achieve what the business was set out to do.

Once a company’s shares are available in the equity market, there is now a very natural and supposedly “efficient” pricing mechanism for these shares. It is (as I said “supposedly”) efficient just through the amount of information that is available on any publicly traded company you could care to dig into. Of course, the more people hear good news of a company and the longer that good news keeps coming, the price of the shares will continue to go up. The opposite happens with a continual stream of negative news. These various and continual stream of bits of information serve to give investors reason to vote for the company by buying shares or vote against the company by selling shares. The pull and push of these, in the short term sets the trading price. This is why the father of value investing Benjamin Graham said that, “In the short term the market is a voting machine….”

It’s similar with with potatoes. Because you have many potato farmers selling their products to millions of people through a multitude of grocery stores and produce markets, these sellers have to ensure their price is competitive, while at the same time the farmers need to be able to at least cover their costs along with making some money to live on. We do sometimes get extremes where the farmer could actually be losing money because there is an oversupply or significantly reduced demand on potatoes at which time the natural market forces eventually work to correct that.

Now, going back to the craziness that has been happening between the social media’s strength in numbers vs the big money….

The one thing you can’t do with a potato (which you can do with an equity stake / stock in a business), is sell a potato “Short”. The ability to sell a company short has produced some extreme price movements in a few companies. Although, it isn’t the short selling that has created the price fluctuations. Rather, it is what a gang of people through 1 social media outlet (Reddit) have been doing to stick it to the big short sellers (Hedge Funds) which is creating a “Short Squeeze”.

“Selling Short”, “Short Selling or simply “Shorting” is another pricing mechanism (voting tool) within many the investment markets. Although it is a speculative one because it has a pre-determined time frame. You are in essence making a bet that a particular company’s shares will be priced lower, within a set amount of time.

“Selling Short” can be done by anyone who believes that the price of a company’s shares are too high. Through a “Short” they take advantage of what they see as an inevitable price decline in the price a particular company’s shares. The short sell is simply a vote saying, the company’s shares are priced too high (buying would be a vote that they are too low).

Of course, the end game is to make money on the vote being placed. Here is an example of Selling Short:

- Someone (Hilary) borrows 1,000 shares of Potato X Co (PXC) at $20 / share from someone (Joe) who already owns PXC. Total current value is $20,000.

- Hilary is promising to give Joe back his PXC shares at a future date along with a fee (based on an interest %). Joe likes this because he planned on holding his PXC shares and the interest he gets is gravy on his investment.

- Hilary sells the PXC shares she has borrowed. She does so on the expectation that she will be able to buy back PXC shares at a lower price, before she has to give back the shares to Joe. After selling, Hilary has $20,000 of Cash.

- The price of PXC does in fact fall as Hilary expected. However, because the price have fallen so significantly, she can buy the 1,000 shares for $4 per share. This costs her only $4,000.

- She gives back Joe his 1,000 PXC shares pocketing the $16,000 (minus a bit of interest she had to pay Joe for borrowing his shares).

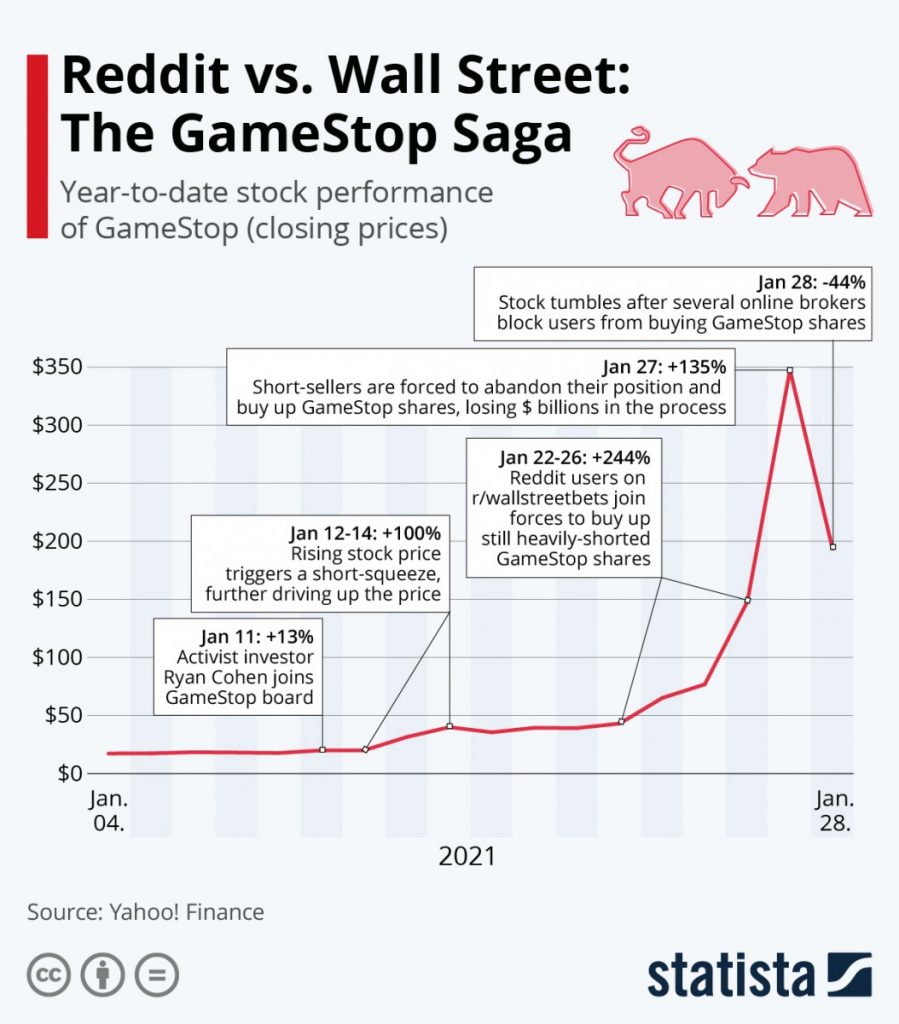

As we all know, a particular company or group of companies can get significantly over-priced. This was driven last week through a following on Reddit, a social media platform. They chatter on the site has been to buy shares of particular companies, the ones that so many Hedge Funds have short positions in. This creates a “Short Squeeze”, when the price is going up, squeezing the short sellers to unwind their short positions by buying the companies they have short positions in.

What does this matter to you and me? Nothing really if you are, as I hope you are (and as I know I am), a long term investor. We are using the equity market to create long term wealth. We participate so as to be able to house, clothe and educate our families (along with providing some of the luxuries in life like travel), through the end of our lives. We are doing so by buying shares of businesses (through a team of highly skilled Portfolio Managers) which are assessed to be under-priced to what they are truly worth. All of these price gyrations created by social media and their chosen fighting partners, is simply investment market noise.

As I pointed out, Benjamin Graham said that, “In the short term the market is a voting machine….”. The other half of that quote is the kicker “…but in the long run it is a weighing machine”. In the end, that is all that matters, the actual weight of the businesses you own. Because if you have investments that weigh more than what they are actually worth because the short term voting has depressed their true worth, their weight will eventually be recognised.

Put another way, the market’s short term votes in aggregate are simply feelings which are fleeting. History has shown that several times a year. Facts (the weighing machine) don’t care about feelings. History has shown that too.