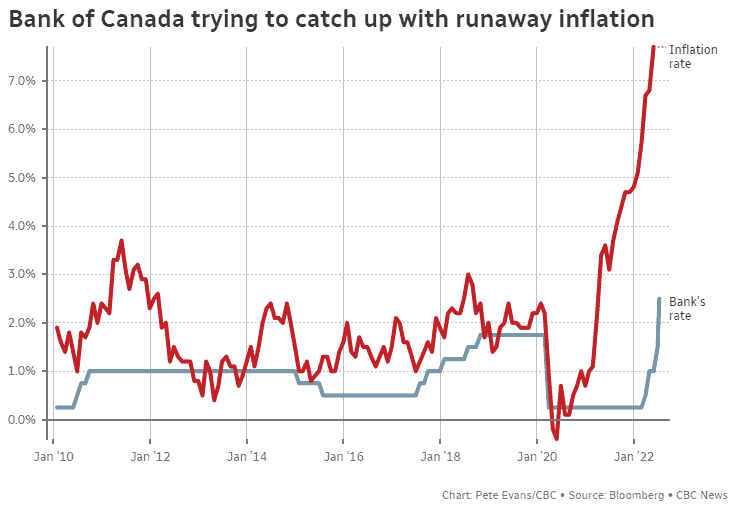

For the past few years we have been stuck getting 1% (and most often Less) on any cash we had sitting around in our chequing and savings accounts. Now that you can get 2, 3 and maybe even 4% to lock up money for 1 year, there seems to be a belief that we are so much better off in that regard, than we were a year ago. The fact is, we aren’t.

The “adjusted for inflation” return on your money is what we have to look at first. I’ll be getting to “real return” near the end of this so, for the time being, we’ll just be talking about your “after (or, adjusted for) inflation” return.

A specific interest rate or return, no matter how high, doesn’t mean anything unless you subtract how much prices are actually going up. Your money has to buy you things, and if your money isn’t increasing at the same (or faster) rate that costs are increasing, you are losing money. The current amount that prices are increasing is “inflation”, which I’m sure you already know.

Just last year, their was much frustration about how little interest our bank accounts were paying. 1%? That’s it? I know I wasn’t enamoured with 1%, but it was in fact, better than it is today. Why? Because the rate of inflation was only about 3%. If prices are increasing by 3% / year and your money is only growing by 1% / year, you are losing purchasing power at the rate of 2% / year. Losing 2% for 1 year isn’t great. But, when you let it do that for many years, you lose ground with each passing year. You may feel good looking at your bank statement, warmed by the fact it is growing by 1% / year but… feelings are most often times, not reality. For many people a sad movie will cause tears, yet what you are feeling isn’t based on reality. I rest my case.

Today is a different story, though. You are losing even more money today on your cash than you were just 12 months ago. Yes, you are getting 3 times (300%) more interest, but you are losing money even faster today. Here’s why that statement is true.

You feel much happier with your 3%. Yet, with inflation currently at 8%, you are losing purchasing power at the rate of 5% / year. Yes, your money is increasing by 3% per year (so your bank statement says) yet prices on every thing you buy are going up by 8%. Higher returns yet faster loss of purchasing power, and we haven’t even factored in income tax yet.

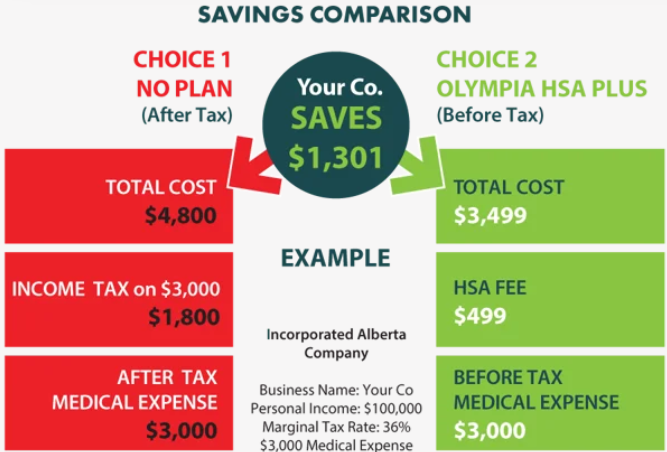

Income tax is what you pay on the interest you earn. After you subtract the rate of inflation, you have to take into account income tax. The sum of those 3 numbers is your “real return”. This is what you really make, not what you “feel” you are making. This is the true number and it doesn’t hide behind what you feel. Just like a good coach, the real real return tells you where you actually stand. It doesn’t give you a trophy and pat you on the back when you are losing. It tells you where you really stand.

So, let’s see what a “real return” actually is today:

$100,000 earning 3% / year in an inflationary environment of 8% / year. This tells us that the “after inflation return” is -5% each and every year this holds.

$3,000 of interest in the 1st year is subject to income tax of 35%, which is about the middle of the road tax rate for anyone earning between $86,000 to $155,00o. This means the tax payable is about $1,000, which works out to 1%.

Your after inflation return is -5%. Subtract the income tax of 1% and you have a real return of -5% / year. Last year your real return would have been about -3% / year.

Yes, I know. I hear it all the time, “at least I haven’t lost 8% since the beginning of the year like my portfolio did”. That is true, you haven’t. I would correct that term “lost” however. Your portfolio didn’t lose, it declined. You only lose when you sell. A decline on a high quality portfolio has always been temporary. Therefore, 1 year from now most likely will be a completely different story. Your portfolio will, if 200 years of investment history is any indication, will be well out of that temporary decline and much farther ahead. Purchasing power loss is permanent if you are emotionally stuck to lending your money to a bank. The loss in that money is probably permanent. You’ll never get that money back again.

As a good coach won’t keep letting you lose by lying to you to make you feel good. Neither will I. We both want you to succeed. The best thing to do is to look forward 1 year and take advantage of the lower investment prices rather than being fooled into believing that you are better off with 3% (or even 4%) today.