We have just experienced the 2nd best 25-day rally on record. #1 was in early 2009. The question is, have things gone up too far too fast? Will we head back down again for a bit? The answers to those questions are “Yes, I think so” and “There’s a 50/50 chance”. Although, a poll of financial advisors conducted in early April revealed that 81% expected the U.S. equity market to retest the March 23rd low. But, I’d say they are all just guessing and with investment management, guessing is way to get very inconsistent, below average, investment results. However, let’s look at some data.

History shows that equity market bottoming is a 3 phase process. In phase 1, the declines are sharp and fast. There are way more sellers than buyers and the sellers are selling everything, without thought. Fear reigns. We’ve seen all of that, through to March 23rd. Phase 2 is a retracement rally. Most people are sitting on the sidelines with cash to invest, asking themselves “what just happened?” This is where we are now. Phase 2 is often a drop down again and this drop can vary in magnitude; sometimes coming back down to retest the lowest point. Is this still to come?

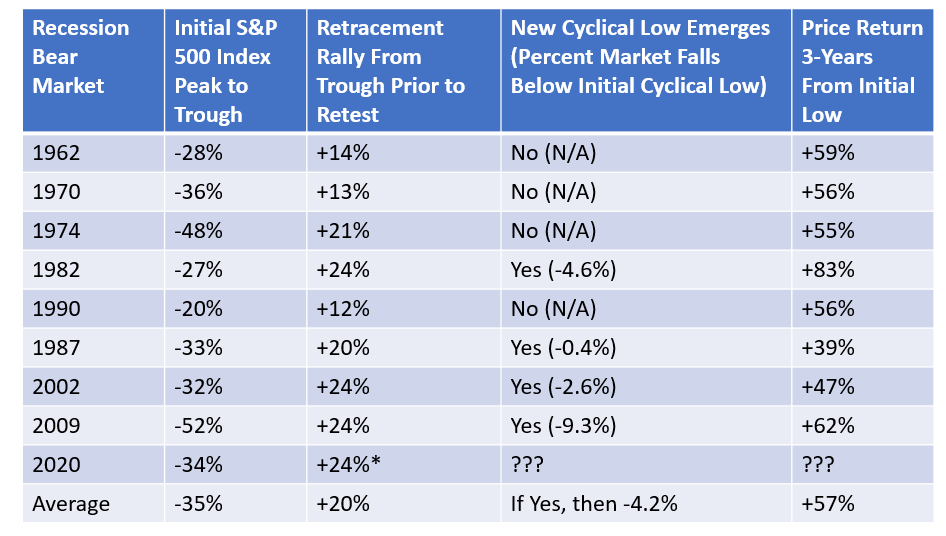

It’s really hard to tell by looking back at 7 bear (down) markets prior to the recessions that followed (notice a key point here: down markets come BEFORE recessions; in anticipation of a recession. So don’t wait for all the bad news to pass before getting invested). These are 1962, 1970, 1974, 1982, 1987, 1990, 2002, 2008. In half the instances (1962, 1970, 1974, and 1990) the first low proved to be the lowest point. In the other half of the examples (1982, 1987, 2002, and 2009), the markets went below the initial low after Phase 2. That’s about 50/50.

What will be the determining factor in which way Spring / early Summer 2020 goes is if some unexpected, significant bad news will follow. Without that, March 23rd will be the lowest point. Does it really matter what happens, though? If you are truly an investor that wants to create long term wealth rather than be a speculator, one who tries to guess what is going to happen, I’d say absolutely not.

Why do I say that with such conviction? Because 3 years out, the average historical returns from the initial lows was +57%. The lowest 3 year return was +39% following the 1987 low and +83% after the 1982 low.

If you break that down between bad news coming after the initial low point and things going past that low or if they didn’t, the 3 year average returns are 57.8% and 56.5% respectively.

Source: Bloomberg L.P. All data are represented by the S&P 500 Index* – as of April 27, 2020. Performance quoted is past performance and cannot guarantee comparable future results.

So, as you can see, it doesn’t matter. Fight your emotions so you stop being hung up on whether or not markets will retest their initial lows. Allocate your money to 1, 2 or 3 Portfolio Management teams (I use 3 for clients and my own portfolio), those with a very good long term track record and highly disciplined investment process and let them make the decisions on what investments should be bought at what price. That’s what I’ve done and I’m fully invested. I’ve done this because I can see with much greater certainty where I’ll most likely will be in 3, 4 and 5 years.