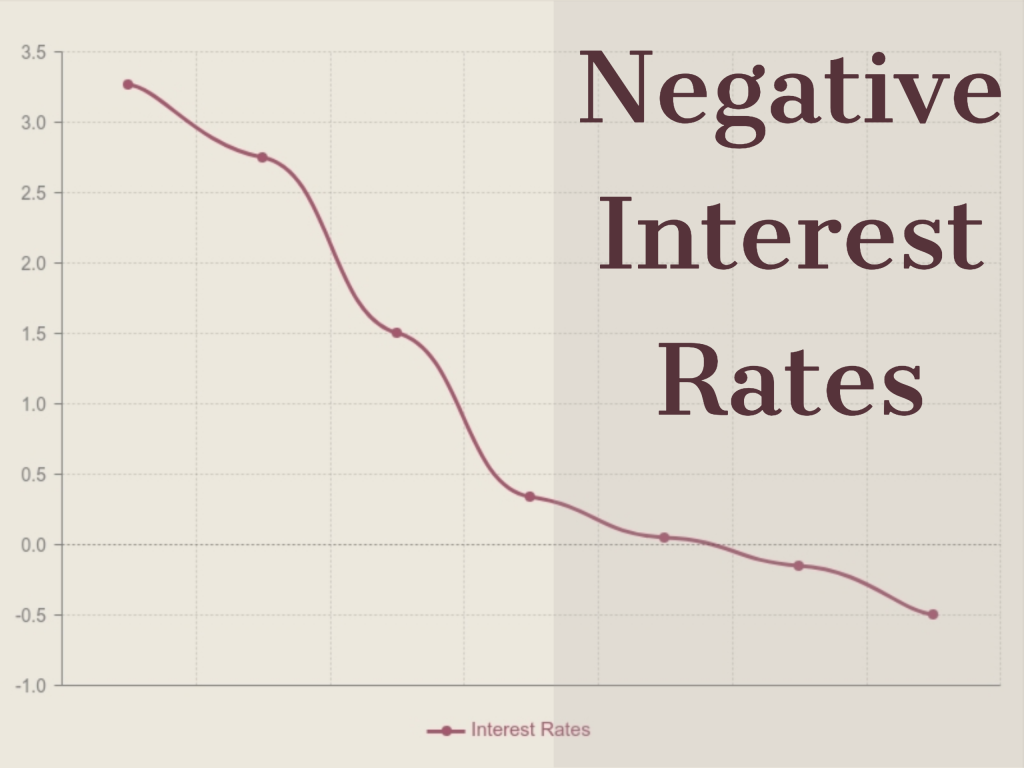

Shouldn’t it be that I get paid interest when I deposit money? Yes, normally however there is always another historic first event and today it is that the Greeks are having to pay the bank if they want to deposit money. Ironic because just 3 1/2 years ago, interest rates were closer to 10%.

The other side of that coin is borrowers and that flip side is truly, exactly the opposite. Borrowers actually get paid to borrow money. Sounds crazy doesn’t it? I take out a mortgage on a house and the bank pays me? Seems like a slam dunk thing to do but the reason people are reluctant to do that in a deflationary environment is that the asset you buy could be falling in value faster than what you are paying. Again, the purpose of the negative interest rate is to encourage spending and / or investing to move the economy forward.

Interest rates (the cost of money) is the most powerful tool Central Banks around the world have to heat up or cool economic growth; inflate or deflate. The current trend of negative interest rates is to ward off deflation. The whole world experienced deflation throughout the 30’s. Modern day Japan knows all about deflation. They have been trying to turn their deflation environment around for almost 30 years. They had real estate prices falling by 70% through to 2002. Since that time they have finally just come back up to where they were in 1989.

That is what the tool of negative interest rates is used to avoid; a deflationary environment. Trump even Tweeted about a month ago that the Federal Reserve (the US Central Bank) should lower interest rates “to zero, or less”.

I remember a Portfolio Strategist, who I followed closely in the early / mid 90’s and advised on the economic big picture for tens of billions of investment dollars. His thesis was that interest rates would go lower than what we had ever seen in history. Over almost 30 years, his thesis played out. More recently, another portfolio management team leader who oversees approximately $70 billion of investment assets (my client’s included in that) has been saying for the past 10 years that the debt the world has accumulated through a borrowing binge, will take decades to unwind. It’s been 1 decade so far.

So what do you do with all of that? The best way to not only survive but thrive in a very slow growing economy is to invest in a global portfolio of businesses. These business must have:

1) Consistent earnings which have risen over time.

2) A “moat”. I’m not talking a deep ring of water around it but rather a unique product or service that is really hard to compete against and because of that, can raise its prices more than what anyone else can, for their product or service.

3) A bullet proof balance sheet.