Investment firms have started to publish their investment forecasts. These mostly state where they think the S&P 500 index will end up. So far, it looks like the range is between 3,800 to 4,200 which is about 4 to 15% above current levels.

These forecasts are reported widely and many people digest them; despite the fact that history shows forecasting markets is very inaccurate when we look back. All we have to do is review how numerous investment market prognosticators expected 2022 would end – anywhere from -3% to +17%. Now of course, we are only in October, with the S&P at -23% since January 1st. The S&P 500 could get to within the projected range however…. what does it matter?

First thing to notice is that the projections usually have a mid point or average of about 8 to 10%. This is what the long term historic compounded annual rate of return for the S&P 500, is. However, as we all know from experience, getting an 8, 9 or 10% return in any given year isn’t very common.

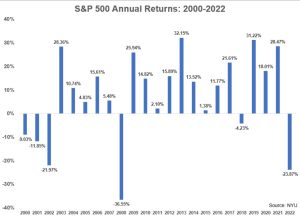

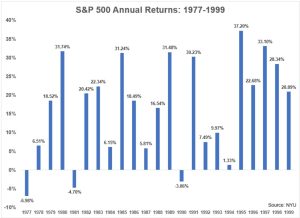

To show you what I mean, here are the year by year returns for the S&P 500, over the past 45 years:

As you can see, there aren’t many 8, 9 or 10% returns in those yearly bars. We would all love to get 8, 9 or 10% consistently every year however we don’t, we won’t and we shouldn’t expect it. The 8 to 10% average rate of return comes from many years of getting supersized returns, several years of weak or painful down years, and a few years of very boring returns.

I love what the legendary and very highly successful investor Peter Lynch, said in a speech on October 7th 1994:

Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs… Basic corporate profits have grown by about 8% per year historically; corporate profits double about every 9 years. That means the stock market should double about every 9 years. The next 500 to 600 points of the stock market index? I don’t know where they will go. I do know the market ought to double in the next 8 or 9 years. They’ll double again in the 8 or 9 years after that. Because company profits go up 8% a year, the stock prices of businesses will follow. That’s all there is to it.

In that speech, Peter Lynch was referring to the Dow Jones Industrial Average (today, we use the S&P 500 index as a common measuring stick). 28 years ago, the day he said those works, the Dow was at 3,797. 8% per year would put the Dow at about 32,700. Today it’s around 29,600 or about 7.7% per year. I’d say Peter Lynch’s common sense assessment, one that would pull us away from the noise of daily news and market prognosticators, is a good one to follow don’t you think? This means stop trying to guess what is going to happen in the short term to try to insulate yourself from investment price declines.

Me? I’m going to keep adding to my portfolio as my cash flow allows, particularly when investment prices have fallen significantly, at which time I may even borrow to invest. That is the only system that has consistently proven to work over the long term.

PS. At age 59, I probably won’t need to start drawing from my own portfolio for at least another 12 years from now (probably longer) at which time, the vast majority of my wealth will continue to be invested and grow for another 20, 30 or more years. That’s a lot of doubling.