Is “the market” getting ahead of itself? Sure, things are looking better than they did a couple of months ago but, there still is a lot of uncertainty out there. The market seems to have rebounded strongly. So have social interactions. In some place they have gone from solitary confinement to Woodstock 2020. We still don’t know if we’ll see a V, W or U-shaped economic recovery. Frankly, we won’t know that until after the fact. So, the only way to determine if “the market” is ahead of itself is to look at today’s data: Earnings per share, both current and projected.

The precipitous fall in the S&P500 index up to March 23rd (which is 500 US companies) told us that US corporate earnings were expected to fall by 34% this year. Every day since then, any firm or institution managing investment portfolios has been and continues to try, to determine if that number is accurate or not. Will it be worse or better than expected?

No matter what the answers are to those questions, as time goes on, earnings for healthy, growing businesses, increase. Earnings may go down more than expected but they don’t stay down. When you look at the most recent earnings expectations for 2021, they are only 15% lower than they were at the start of 2020. That puts “the market” exactly where it should be today.

Looking further out, through to 2022, corporate earnings are only expected to be 11% lower. Prices for US companies, after the strong rebound from the March 23rd lows, are actually quite in line with future expectations. Equity markets are always forward-looking and they’re valuing businesses today based on where they think earnings will be in the future. But that doesn’t mean it will be smooth sailing through to 2022. There will be definitely be positive as well as negative, surprises.

Those numbers are all based on “the market” as a whole. If you look under the hood of “the market” you will see that, over the past 2 ½ months, there have been only a relatively small number of companies whose share prices are up substantially. These have increased much faster than the rest.

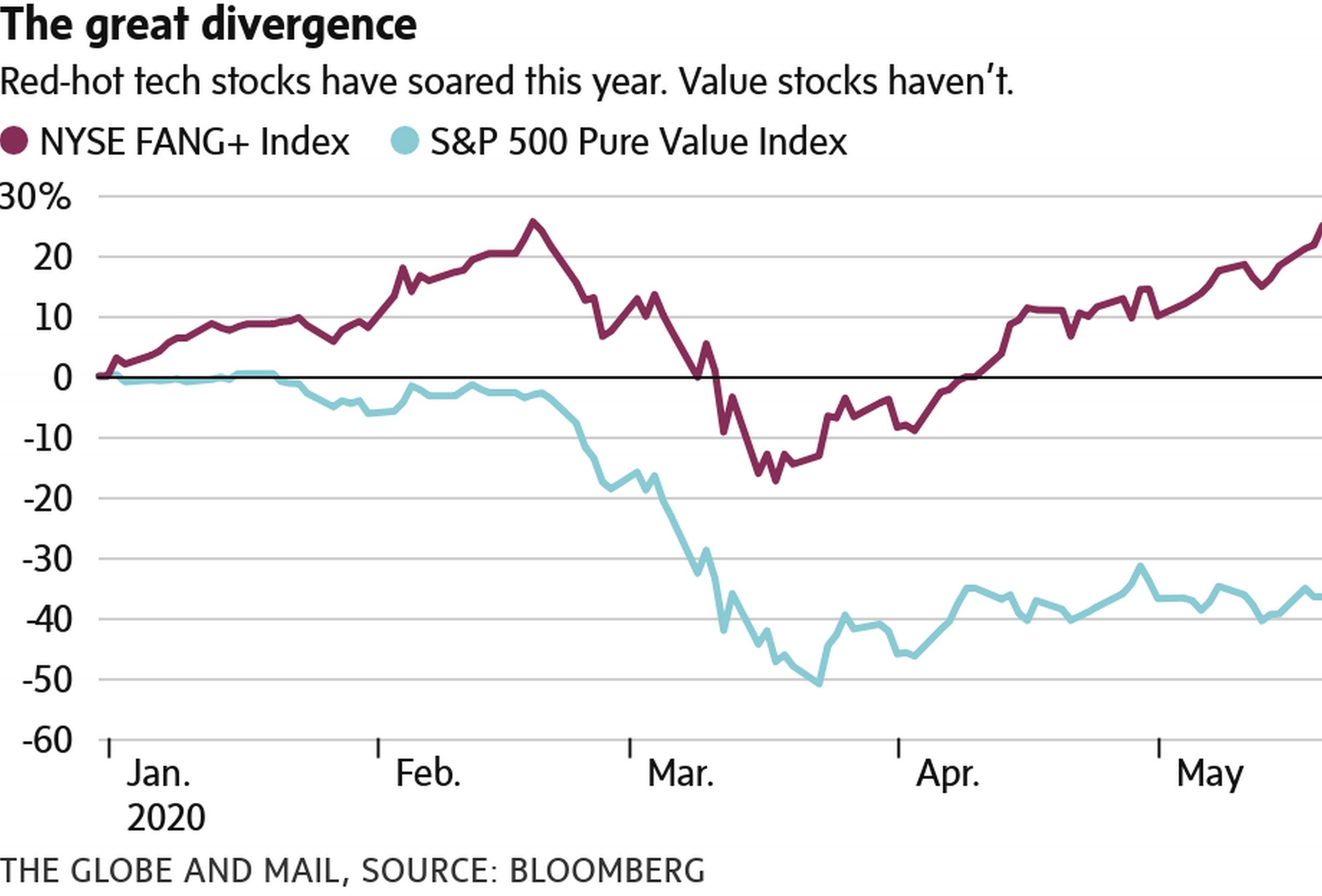

This has created a highly unusual divergence, one that has widening. This is shown in the graph below:

The companies represented by the purple / red line (depending on how you see colour), are mostly tech-oriented business and other companies that have been doing particularly well during the worldwide lockdowns. The market’s rise is due mostly to these “obvious survivors”, the businesses that everyone knows will continue to thrive, despite how long it takes to discover a vaccine for Covid-19. If you haven’t read about obvious survivors and non-obvious survivors, I’d highly recommend you go to the BloG I put up on May 19th 2020.

The obvious versus non-obvious survivor separation has created an extreme price disparity between these 2 groups of companies. The chasm of a what people are willing to pay for one kind of business versus another is so wide, it is in my mind, way beyond reason. We haven’t seen this kind of price disparity in 80 years. Therein lies a great opportunity on one side and potential for permanent loss of capital on the other.

As I said, the obvious survivors are primarily tech-oriented businesses and companies that provide us our basic needs. These kind of businesses were already quite expensive pre-Covid. When lockdowns started, their share prices didn’t fall nearly as much as much as most other companies. They have also rebounded stronger than most, since then. Despite what we have gone through, since January 1st, they are up by 20%. Based on basic business valuation measurements, they are more expensive today than they were at the start of the year. Full blown optimism without caveats. No discounting has been made or factored in for uncertainty or potential ramifications the next several months could bring to these businesses.

On the other side are the non-obvious survivors. This group doesn’t simply mean all other businesses. Also, just because a company’s share price hasn’t gone up much, or is still way below its high point, doesn’t put it in the non-obvious survivor category, either.

The blue line in the graph represents those businesses that can be classified as “value”. Within that large group are many that we in the investment businesses call “value traps”. These are businesses that look cheap and are for very good reason. They are cigarette butt companies. You may get a few more puffs out of them but that is it. There are many businesses out there that will have a few very tough years ahead of them. Some will outright, fail. These include many in the oil industry along with airlines. There are still others which will be detrimentally affected by a secular shift in how business is done going forward (ie will more people be working from home?). These businesses will never be the same again.

Non-obvious survivors are a different group. They are businesses that today, still have healthy revenues which shouldn’t be affected much. Yet, their share prices haven’t recovered to near what they should. They also include businesses whose revenues have been affected by the lockdowns however, this will be very short-lived. Many of these businesses saw their share prices fall by 50% or more, which in many cases was way more than is justified from a purely business valuation perspective. Since then there has been a 30% increase from their lows. Despite that, many of these businesses are still well below their true value.

To give you a simple perspective on how wide the price disparity is between the obvious and non-obvious survivors, one only has to look at a company’s net earnings versus their current share price.

Here is hypothetical example: $100 per share for a company that generates $1 of net earnings per share.

This means, for some of the most expensive obvious survivors, it would take up to 100 years to get paid back your money. This is assuming their business continues to operate at the same level it is doing, today. For many of the non-obvious survivors that payback period is less than 10 years ($10 per share for a company that generates $1 of net earnings per share). Very simply put, some obvious survivors are 10 times more expensive than the non-obvious survivors. The simple mathematical fact is what you pay for an investment determines your future returns. Being a rational, business minded person I’m sure you’ll agree with me that we want to own the non-obvious survivors. They have healthy businesses models yet their value isn’t being fully seen.

Today, people are paying way too much for their infatuations; ignoring all the other excellent businesses (non-obvious survivors) out there. This “going gaga” has expanded the past few weeks. That is evidenced by how the number of Google searches for “day trading” and “call options” has exploded. Also, many people have bought shares in companies that have recently declared bankruptcy. They are betting that these companies will be able to successfully negotiate and restructure their massive debts and climb out of the ashes. The other side of that coin toss? The company’s shares will be worthless. These are all clear signs of speculation (gambling) and that kind of investing (I use that term loosely here) can only produce short term gains, not healthy long term returns and sustainable wealth building.

Data has shown time and time again that the price you pay determines future returns. It also spells out how much risk you are taking. In past significant market downturns, there have been multiple false recoveries, so it’s possible we could see markets fall again. Until we are past the threat of a second peak or a mutation of the virus then there is always the threat of another correction. Investors should be wary of overconfidence. We are seeing a lot out there.

So, yes “the market” is only 12% off of its market high on February 19th (using the S&P 500 Index) after making a 40%+ rebound from its subsequent lows. Interestingly enough, my clients in aggregate, many of which have a long-term growth oriented tilt to their portfolios, are down approximately 12% as well from the high. The irony is we don’t (and never did) own any of the obvious survivors. I give that credit completely to the portfolio management teams that have continued to think and act like “business people buying businesses”. We’ve benefitted from the recovery while standing outside of the euphoric party that so many others are taking risks in.

What our portfolio management teams have been doing recently is what they have always done. They are continually looking at every company they have bought for themselves and our mutual client’s portfolios and determined if it is the best place to invest money. Over the past few months, some companies were sold. A handful of new ones were purchased and many existing holdings were added to. All with the objective of continual upgrading of portfolios so as to ensure that future returns will be as good as they can be. As one of the team members has said more than once (I’m paraphrasing here); “we do a lot of work researching a business before we decide to make an investment. Once we decide it is a good business to invest in and after we make the initial investments, we are always looking to find what we missed. Did we make a mistake?”. This is contrary to what so many other people do which is finding all the evidence to support their decision (confirmation bias). Sorry for my digression…

I’ve said many times before to clients who have been concerned about how high “the market” is by telling them, “You don’t own the market”. I don’t either. We have a carefully selected portfolio of investments that are continually being analyzed to determine if they are still the best investments to own, for the next 1, 3 and 5 years. Today these are the non-obvious survivors and are still very much, undervalued.

PS. If you want a 2nd opinion on your portfolio, send an email to carey@careyvandenberg.com with a screen shot or pdf of a recent statement and I’d be happy to give you my comments.