Yes, you read that right. If you tick the “YES” box, to have life insurance on your mortgage, you may not actually collect the life insurance when you expect to and most need it.

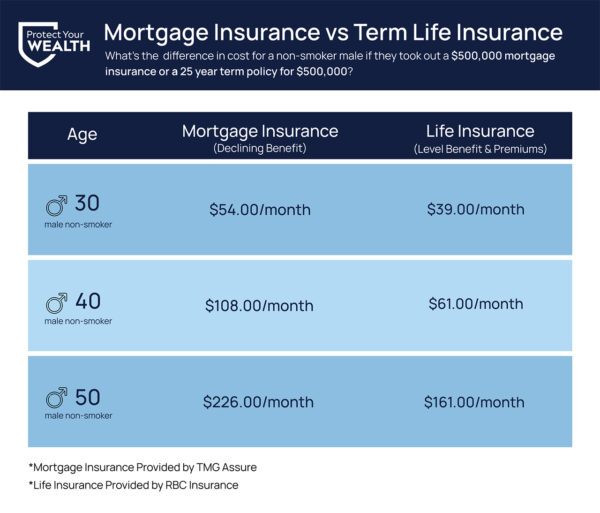

So why do people (you may be one of them) sign up for this kind of life insurance? First is, “I didn’t know that!”. That aside though, virtually everyone considers it to be a rather small amount per month (especially compared to there monthly mortgage payments) and it gives peace of mine, right? The fact though is this. You are (or will be) paying about 50% more for this kind of “insurance” (I use this term loosely) AND you may not actually be insured. The tragedy is you won’t find that out until it’s too late.

Here are some universal facts on life insurance attached to your mortgage. Read through these points first. When you’re done, I’ll give you the tragedy part (why you may not actually be insured):

- If you purchase mortgage insurance from your bank or credit union, you are purchasing creditor’s group insurance.

You are a certificate holder not an owner of the policy. This means the bank may make changes to the coverage without your consent, and coverage will end as soon as the mortgage is paid off. - The premium you pay remains the same, but the coverage decreases along with the balance of your mortgage. You are paying a level amount but the coverage is decreasing.

- You are not able to name your own beneficiary (the person who will receive the money). If something should happen to you, the bank is the beneficiary. They get the insurance proceeds paid to them directly.

- If you decide to change banks at a later date, you will have to reapply for insurance coverage. You will pay rates based on your age at that time. If your health has changed, you may be declined.

- In most cases, creditors group is based on “blended rates,” meaning that smokers and non-smokers pay the same amount for the same coverage. If you live a healthy, low risk lifestyle, you will pay the same amount as those who are higher risk of premature death.

Yes, those are all very important facts. As well, you get to pay 50% more per month than if you bought your own life insurance. The biggest risk to you is this, though. Life insurance attached to a mortgage uses “post mortem underwriting”. This means that the life insurance company decides whether or not your mortgage will be paid off AFTER a death occurs. Watch this CBC Marketplace episode on this topic and you’ll see how dangerous this is.

If you buy your own life insurance policy:

- You have a policy that you own and you are completely in control of. An individual mortgage insurance policy, obtained directly from a life insurance company, puts you in control of your own coverage. If you decide you want to keep some or all of the insurance after the mortgage is paid off, you may do so. That is your choice and your choice alone.

- Your insurance is for a fixed amount – it does not go down (although you can get insurance policies that decrease over time). If you purchase a policy for $500,000 and you die when your mortgage is only $200,000, your heirs will receive the full $500,000.

- You may name whomever you please as beneficiary – spouse, child, grandchild, even a good friend. They receive the funds directly from the insurance company, meaning they are free to decide whether they want to pay off the mortgage or use the money for another purpose. Maybe invest earning 6% / year and use that to pay off the mortgage @ 2% / year?

- An individually-owned policy is fully portable. When your mortgage renews, you are free to shop around for the best rate. If you decide to change lenders, your individual policy will come with you, completely unchanged from when you first obtained it. You will not have to reapply for coverage, and your monthly insurance costs stay the same.

- An individual policy is underwritten based on your individual circumstances. If you lead a healthy lifestyle you will pay a much lower rate (or pay for more or better coverage).

- If you need more life insurance than the amount to cover you mortgage you will be able to have 1 large policy instead of 2. This will further reduce your insurance costs since life insurance is cheaper on a cost per $1,000 of life insurance basis. The more you buy the better value you get. Again, most likely you could be paying about 1/2 the price of what you are (or would be) paying with life insurance attached to your mortgage.

- When you are approved for the life insurance coverage you are guaranteed to be paid out that amount upon the death of the insured. Why? Regular life insurance does their underwriting (health checks) pre-mortem (while you are alive). They approve you based on the facts they get from you (and maybe your doctor, blood sample etc.) before they give you your policy. No surprises down the road.

If you want a review of your entire financial situation including your insurances coverage(s), I welcome you to contact our office to set up a meeting. You’ll have someone working for you rather than someone working for the bank. As well, pass this on to anyone you know who has a mortgage. You could be the one saving them from a lot of financial pain, when they are experiencing high emotional pain.